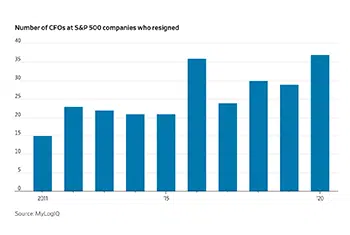

More chief financial officers resigned from large U.S. companies in 2020 than in previous years, as the pandemic put pressure on corporate balance sheets and the executives who manage them.

Thirty-seven companies in the S&P 500, including General Motors Co. and HP Inc., last year said that their CFOs would quit, up 27.6% from 2019. The figure for 2020 is higher than the average number of resignations over the past decade, which totaled about 25 a year, according to data provider MyLogIQ. Resignations are typically voluntary, as opposed to terminations, but the language in corporate filings can sometimes be ambiguous.

That is contrary to what recruiters had expected in the early days of the pandemic—some predicted executives would stay put—and comes after years of heated competition for finance talent.

For many CFOs, the pandemic added to an already high workload and long hours. Their roles have become more central in recent years, as finance chiefs, the right hand to their chief executives, often not only manage the books, but also their company’s strategy.